I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

The World Of Hyatt Credit Card

World of Hyatt Business Credit Card

Right now there are new offers available for Chase’s consumer and small business Hyatt cards, so it’s worth taking a look.

- The World Of Hyatt Credit Card: The initial bonus offer is up to 65,000 World of Hyatt Bonus Points: 35,000 Bonus Points after spending $3,000 within the first three months from account opening, plus you can earn up to 30,000 more Bonus Points by earning 2 Bonus Points total per $1 spent on purchases that normally earn 1 Bonus Point for the first 6 months from account opening or up to $15,000.

This is 5,000 more points that the previous offer after spending $3,000 within three months, and the additional points-earning at two points per dollar remains the same.

The card is fantastic for earning Hyatt elite night credits (5 qualifying nights per year as a cardmember, plus 2 more for every $5,000 spent on the card), and it’s the card I use for Hyatt spending at 4 points per dollar. It’s worth putting $15,000 spend on the card for many. That’s because you receive 1 free night every year after your cardmember anniversary at any Category 1-4 Hyatt hotel or resort and you also earn an additional free night at any Category 1-4 Hyatt hotel or resort if you spend $15,000 during a year.

Alila Marea - World of Hyatt Business Credit Card: The initial bonus offer is up to 75,000 World of Hyatt Bonus Points: 60,000 Bonus Points after spending $5,000 within the first three months from account opening, plus 15,000 Bonus Points after spending $12,000 in the first six months from account opening.

Previously the offer was just the 60,000 Bonus Points after you spend $5,000 on purchases in your first 3 months from account opening. So this adds the additional 15,000 based on spend within six months.

The card earns status even faster than the consumer card based on spending at 5 Tier-Qualifying night credits toward status for every $10,000 spent. And cardmembers receive up to $100 in Hyatt statement credits – spend $50 or more at any Hyatt property and earn $50 statement credits up to two times each anniversary year.

Seabird Resort

Hyatt has a better loyalty program than Marriott, IHG, and Hilton (pretty clearly, in my view). The cards are good, though not amazing. It’s the contribution towards World of Hyatt status that matters here. You get elite nights just for being a cardmember with the consumer card, and spend on either earns not just redeemable points but can also earn nights towards status.

Globalist breakfast at Park Hyatt Vendome, Paris

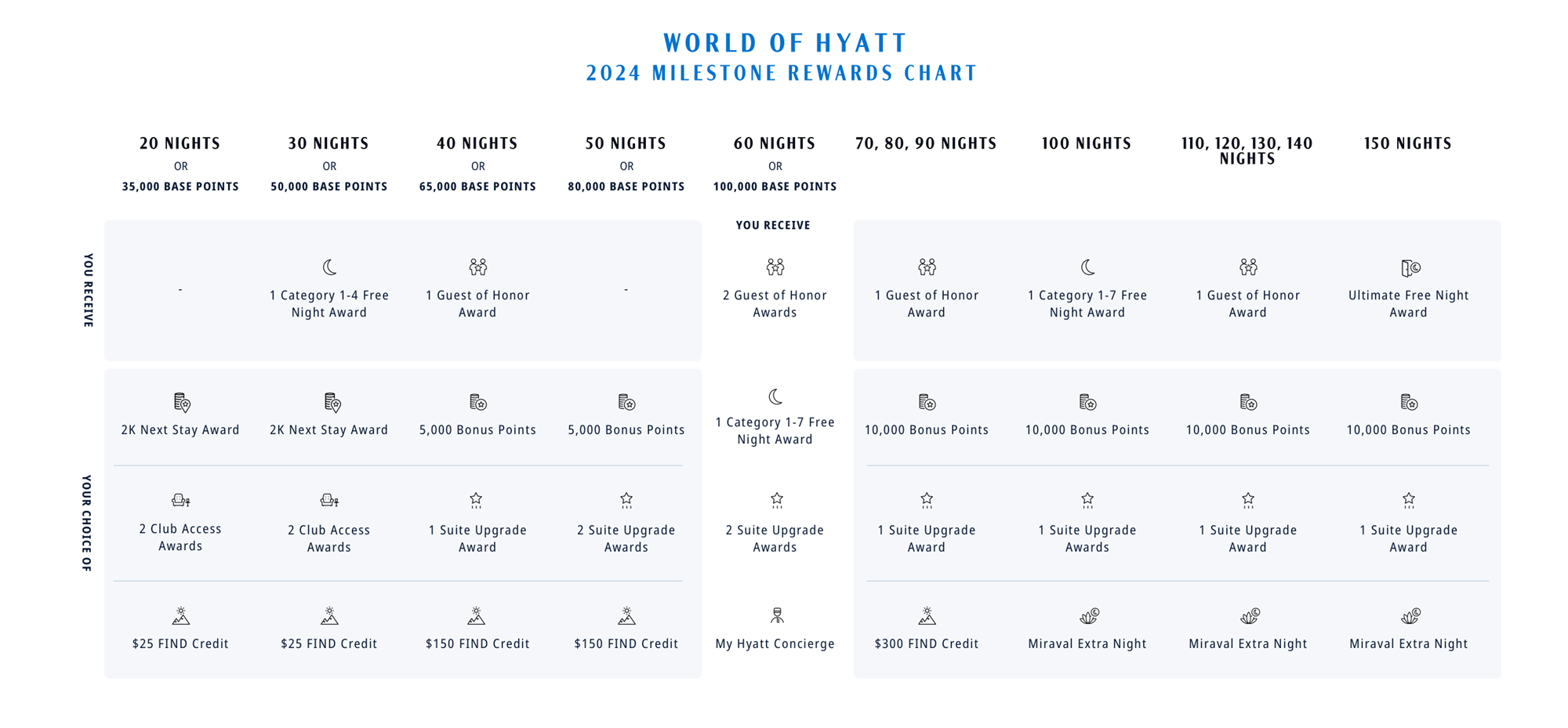

Hyatt offers incremental rewards for every 10 nights stayed, starting at 20 nights, now up to 150 nights each year.

With spending on the card I can really boost my qualifying nights, and I push well past the 60 nights I need for Globalist status, a dedicated concierge and other benefits. I have ample confirmed suite upgrades so that my stays with family are in suites. And now all of Hyatt’s award certificates are fully transferable.

Perhaps because the elite program’s Globalist status largely sells itself, they don’t really do major bonus offers most of the time, especially for the consumer card. Any increased offer with Hyatt is notable.

Wake me up when something of value happens with this card!

Hyatt is among the best transfer options for Chase Ultimate Rewards points. Hence, you can think of this as a supplemental supply of UL points when you run out of standard Chase options