There are two challenges credit card companies face in marketing to consumers.

- Getting potential customers to apply for the card

- Getting cardmembers to use the card

I already knew that the new Bilt Mastercard had a unique approach to the first challenge. Receiving my Bilt card I now see they have an interesting approach to the second as well.

Knowing Who Your Customers Are, How To Find More Like Them

That’s the fundamental challenge in all of marketing. You need to know who are your customers and then you go out and find more people that are like them.

Pitching credit cards inflight is a target-rich environment for airline cobrands. Where are you going to find as many people interested in an airline’s miles than… on the plane? What’s more, you’re reaching them when they are actually thinking about travel… and when they may be bored, or have fewer things that might trump applying for a new card.

One of the biggest challenges that card issuers have is first figuring out who their customers are. When I’m pitched a new product the first question I always ask is, “who is this product for, and how does it solve a problem they have or deliver more value to them than what they can currently buy in the market?” If the answer is “it’s a card for people who value experiences over things” I know the product is a dud.

It’s possible to do ok with an also-ran, picking up a small slice of a huge market almost by accident, but usually those products perform poorly. Marketing a credit card isn’t really any different than marketing other consumer products. You need to figure out how to deliver more value to customers in a way that they value, and do it at a price that’s below cost (broadly conceived).

Bilt’s customers are primarily young urban professionals. It’s an upwardly mobile demographic. And they reach them in the high rise apartments they live in in big cities. They convert tenants in partner buildings into cardmebers by letting them earn rewards charging their rent to the card. That’s an incredible distribution channel to reach a highly desirable demographic.

You’ve Gotten Your Card In A Customer’s Wallet, Now They Need To Use It

Increasingly card issuers make cards available in some fashion right away. For instance, you might apply for an airline credit card as part of the booking path on the airline’s website and if you’re approved use that card for the ticket purchase.

The most important insight is that a customer is most interested in using a card at the time they apply. They’ve been motivated to action and they’re excited. It’s insane, then, to make them wait a week or more to get their card before they can start using it. “Life moves pretty fast” and a whole lot faster than when Ferris Bueller first spoke those words 35 years ago. Enthusiasm wanes and people move onto other things. Issuers have a short window to take advantage of enthusiasm and develop consumer habits.

The Bilt card isn’t alone in this, but it’s a useful innovation that cardmembers receive their card number in the program’s app instantly so they cab begin using their card online (or for any ‘card not present’ transaction). They can also add it to an Apple Wallet.

I’ve always thought a big issuer would get a ton of value out of working with major e-commerce platforms to autopopulate new cards into member accounts. Who wants to change the card they use for their Netflix subscriptions, add a new card to Uber, or change their default payment method for Amazon? And when you have a card that’s your default payment method in many places who wants to cancel that card?

Barclays used to regularly offer new US Airways Mastercard customers a series of targeted promotions after they’d opened a new account. The initial bonus didn’t require spending so spend promotions served to get customers using the card.

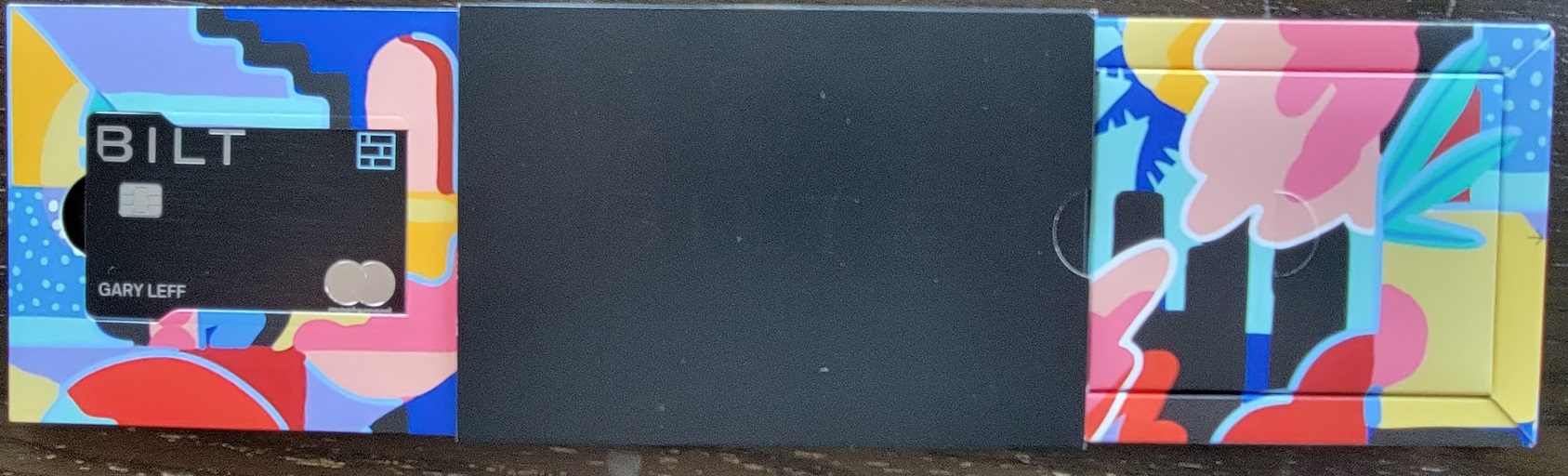

Here’s something that Bilt did that I found interesting. They invest in clear communication and a really premium unboxing experience. I’ve never seen anything like it for a no annual fee card. It felt really premium.

I received a text and an email that my card had arrived and that I should check my mailbox. This came a couple of hours after mail was delivered, and I had literally just opened the box. And the card does come in a box!

Bilt’s welcome kit includes a number of attractive cards with simple messages about the product from using the card to earn points on rent, redeeming for travel, premium Mastercard benefits, and improving your credit score.

I’ve always thought that card companies could consider printing a product’s unique selling proposition right on the card itself. Bilt doesn’t do that, though it’s a stylish hefty card, but they do have simple marketing messages communicated right with the card delivery.

It’s done well, it’s a classy package, and a bigger welcome investment than I’ve ever seen from a $0 annual fee card (or even a $99 fee one). I suspect they’ll need to do more messaging to break through especially with their key audience, though they’re certainly doing that. Still, interesting opportunity to take advantage of a time consumers are thinking their product… when they think they’ll need to activate the card, but no.. no activation required (another premium feature I wish more companies would emulate).

Bilt is fantastic. They have done almost everything right. Rent with no fees was their first win. Hyatt and AA as transfer options was their second win. The instant card number is just a cherry on top. Fancy packaging, frankly, could be done without. Young people are very environmentally conscious and #RefuseSingleUse. There is a lot of excess packaging shown in your photos. Yes we all know paper and cardstock are recyclable, but that is not as efficient as not using it to begin with. We just need a card in a small envelope. Extra materials could be distributed online.

To expand on transfer partners. Hyatt is hands down the most valuable hotel chain for people who care about points, which is basically all young professionals. AA is a lousy airline by customer service, but it is still decent for awards. The most important thing Bilt got right in these partnerships are that Hyatt and AA are domestic. Citi and CapitalOne tout foreign partners which are too much hassle for a lot of people.

Way to go Bilt! I look forward to the growth of this company. BTW I personally would pay up to a $10,000 annual fee for a Bilt card with truly phenomenal perks. Young people care about physical and mental fitness, travel experiences, healthy eating, and meaningful social interaction. I am sure Bilt has some great ideas up its sleeve.

@Gary… now tell me you’re not marketing this card 🙂

You missed the 10,000 bonus Bilt points for only $1,000 spend in 90 days.

And yes, the packaging is everything you say it is.

@Woofie – I do not receive referral credit on this card (which i do on most rewards cards)

This Card is Fantastic addition to my wallet. I’m already a gold sitting on 53K BILT Points. 2X for 30 days was a great offer.

Where is the signup link for 10k bonus points?

From your description, it doesn’t sound like you’re the target audience. I doubt you pay rent.

@ABC – I have written that I am not the core demographic, but that it’s a good card period (think of it as Sapphire Preferred without the annual fee) and a great one for those who do pay rent. I do not pay rent, I have a mortgage.