I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Update 12/1/22: Bask Bank Mileage Savings Accounts now offer 2 American AAdvantage® miles per $1 saved annually.

![]()

Bask Bank is the only bank offering a savings account that earns American Airlines AAdvantage® miles instead of interest. There are no fees, and the new Bask Savings Account offers to let you earn several bonuses if you open an account soon.

- 1000 bonus miles for providing online feedback within 60 days of account opening if you open your account by April 30, 2020.

- 5000 bonus miles for opening an account by February 29, 2020 and holding a $1000 balance for 30 consecutive days within your first 60 days of opening the account.

They award you miles for your account balance and currently have bonus offerings for keeping significant balances over the course of the year that really boost your rate of return – and the account has no fees.

In an earlier post I walked through how your earning through a Bask Savings Account makes a lot of sense – not just against the average return of a savings account in the U.S., but even against the high yield offers that are out there. That may have understated the value of what you can do through Bask Bank.

AAdvantage® Miles Are The Currency I’ve Redeemed The Most

Over the years I’ve redeemed more American Airlines AAdvantage® miles than any other currency. When I booked my honeymoon 15 years ago, I cashed in these miles for my first class award to French Polynesia and Australia. I spent miles to go back to Tahiti in business class this past Thanksgiving. It’s these miles that took me to visit my family in Australia last year, and that have taken me four times to the Maldives in first class and countless times in first class to Asia.

- They have more partners offering international first class departures from the U.S. than other the other large U.S. airline mileage programs. That’s what I target as my favorite use of miles.

- Their partner British Airways was the first with a transatlantic flight from my home city of Austin, and I’ve booked that flight several times in both business and first class.

- When it comes time to redeem I’ve loved being able to use my miles for Etihad, Qantas, Cathay Pacific, and more.

I’ve Flown The Etihad First Apartment Several Times While Redeeming AAdvantage® Miles

This Thanksgiving I Returned To the Same Hotel Room Where I Spent My Honeymoon Thanks To Redeeming AAdvantage® Miles

That’s why even though I still have a healthy seven figure balance of miles in my account, I still look to earn more. The truth is though that miles are even more valuable for someone who has almost enough miles for the award they want than for someone like me who can book plenty of award tickets using the miles I already have.

Miles That Put You Over The Top For An Award Are More Valuable Than Other Miles

The value of points at the margin is different than an overall average value. As you approach having enough points for an award, the marginal value of a few more points goes up substantially — since those extra points are what make the award possible.

If you have just 5000 miles in an account there’s not much you can do with those points. They are much lower value than the points you’ll redeem for a business class ticket to Asia or South America.

And if you have millions of miles, the value of the next mile earned is lower too – it’s a long time before you’re ever likely to use that miles.

However miles that put you over the top towards an award, perhaps tipping your account over the 70,000 or 140,000 mile levels, are miles that are going to contribute towards being able to book valuable awards right away.

That’s Why American Airlines AAdvantage® Can Sell Miles For So Much Money

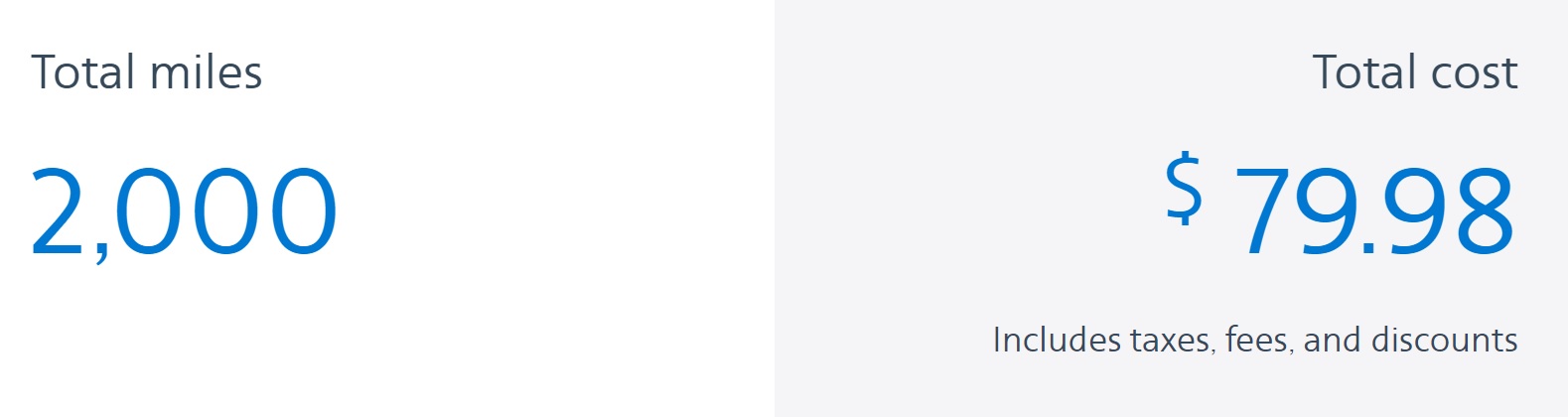

When you need just a few miles to get the award you want, those miles are worth a lot to you. American Airlines sells miles, but when you need just a few miles quickly they can cost quite a lot per mile. For instance it can cost $79.98 to buy just 2000 miles.

Screen shot, American Airlines website

Bask Bank will let you deposit money into the Bask Savings Account, earn miles, and withdraw the money. You can put in just the money necessary to earn the miles you’re looking for to top off your account.

Use A Bask Savings Account To Strategically Load Up Your Mileage Account

I’ve used my American Airlines AAdvantage® miles to book Qantas first class several times, because it’s the most comfortable (commercial) way to fly between the U.S. and Australia and because I have family that lives outside of Sydney. Thanks to these miles I’ve been able to stay in touch with my aunt, uncle and cousins better. I’ve visited for weddings and other major family events, and I’ve even enjoyed the long trip there and back (and back in March I even enjoyed it while traveling with my then-5 month old daughter).

Qantas First Class Seat

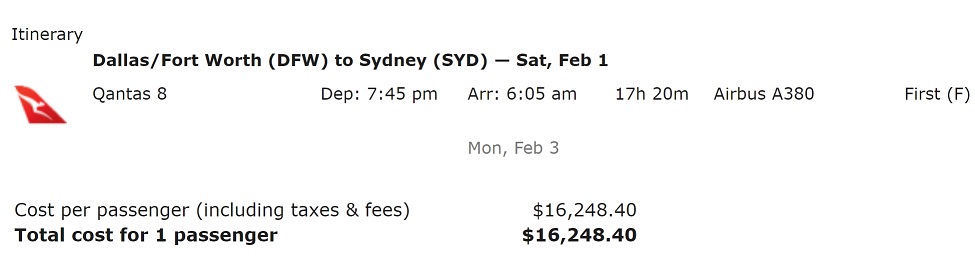

I wouldn’t ever consider myself to be in a position to buy a ticket in Qantas first class. A one-way fare from Dallas Fort-Worth to Sydney can cost over $16,000:

Screen shot, ITA Matrix

I may consider an AAdvantage® mile to be worth 1.4 cents on average but if I had 107,500 miles in my account and wanted to book a 110,000 mile first class award to travel on Qantas, that last 2500 miles would be worth far more to me than $35. They’d be worth many times that.

With Bask Bank you can put $30,000 into a savings account and earn about 2500 miles after a month, and that’s not even factoring the bonuses they’re offering. You can take the money back out of the account after that, since you’ll have earned the miles you need for the award you want to look for. There’s no fees and no commitment.

Of course the ongoing value of what they’re offering is strong, you might want to leave the money in the Bask Savings Account, but you don’t have to – you can earn miles only where they’re most valuable at the margin if you wish.

@ Gary — You must be getting a nice referral on this offer to keep pushing an inferior proposition to earning cash at 2.25% or more. That may change, but for now a fully-taxable 2.25% return is a better deal for most everyone. Maybe you can do better with the Bask offer with the first year bonus, but not beyond, and opening and closing accounts is time-consuming work. It doesn’t take “less than 5 minutes” as stated in marketing lies promoted by certain other financial products. Nothing involving any thought takes less than 5 minutes.

I agree with Gene on most fronts. Opening the account took longer than 5 min but not longer than 10. The “interest” return is certainly higher than at your local bank but I keep most of my cash in an interest-bearing online account currently paying around 2.3 %, taxable. But 6,000 miles for spending 10 minutes of time and parking $1,000 for a month or so seems a no brainier. And what I’m really surprised to not have read about is this immense perk: Receiving even just one mile of interest on your balance every year (whatever that would have to be) will keep your AA account active in perpetuum. For those folks who don’t use an AA-branded credit card, fly only occasionally, or use any other mile collecting strategy this means your AA miles will never expire and you don’t have to worry about it.

How do I open a Bask Bank account? And where are there Bask banks or is everything done online?

Note: The bank treats the miles as taxable interest on the account and issues a 1099 to the government. Read the fine print.

What is the dollar amount of an AA mile as shown on 1099-int?

What is the amount of deposit to earn 1 aa mile per year?

I just spoke with a representative from BankDirect who confirmed that they support both BankDirect and Bask Bank. (Both are part of Texas Capital Bank.)

She said that both BankDirect and Bask Bank will issue Form 1099 and value miles at 0.42 cents. (Multiply miles earned by 0.0042 for the “income” reported on the 1099.)

She also said that BankDirect Mileage Checking accounts are no longer available for new customers. That is because Mileage Checking accounts will be going away in 2020.

Finally, she said existing Mileage Checking customers will be notified via e-mail or snail mail. (She was not sure which format or when in 2020 they would be notified.)

I opened the account and did what I had to to get the two bonuses. Then I reduced the balance to $200. I anticipate receiving a few miles monthly, thus easily and automatically keeping my AA account alive.

@Jurgen Heise: Where are you getting 2.3%. Thanks.

I eat my words–the APY for CIT Bank’s Savings Builder has dropped to 1.85%. My bad.

@ Gary Steiger — You can get 2.25% from Customers Bank at https://www.customersbank.com/ascent/

So, if I put $100K in Bask Savings and leave it there for a year from the date of funding, I will receive 140K miles (and a 1099).

What happens in year 2?

So, if I put $100,000 in Bask Savings and leave it there for 360 days, I will get 140,000 AA miles, correct?

What happens in year 2? 100K miles but no bonus?

I can get better rates in my brokerage account buying CDs

Laughable.

Does the mileage accrue monthly or annually?

Note that you cannot transfer more than $50k per day or $100k per month

you have made the same post 3 times in 10 days…the commission on this one must be hige

A true sweet spot here is just opening accounts with $1K ea, do the survey, and then 30 days later withdraw your money and move on. An easy 6K/person, more than enough for the 5K Economy Web Special one-ways, for me (among many other current choices) I can fly short-notice almost any day nonstop the the west coast from my medium-sized city east of the Mississippi.

Gary ….. Help us please! Do you have a chart of points required for travel with various airlines? My need is flights to Sydney AU from the US. What airline, what best value, what points are best to accumulate?

Many thanks,

Grandma

I’m very unhappy with the Bask bank application process. They use an intermediary to transfer funds from brokerage accounts, like Schwab and Fidelity. I entered my info for both accounts (username and password). Both were rejected with a message saying that “two factor idenfication is not supported for this institution”. Now they have my usernames and passwords. A pop up could have appeared stating accounts with two factor identification are not supported before stealing my username and password!!!

This is the last article I read of yours. Do you really think average people that read your blog are that stupid? I’d rather read TPG any day over this drivel.