I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Chase Sapphire Reserve launched three years ago and revolutionized rewards credit cards. Chase Sapphire Reserve® offers an initial bonus to earn 50,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. And it earns 3 points per dollar spent on travel and dining – great points that transfer to frequent flyer programs or can be spent directly on travel. It has a $300 annual travel credit, and provides airport lounge access with a Priority Pass card.

While other cards have come along and upped their game since Sapphire Reserve’s introduction, this guide should tell you whether it’s still the best card for you to keep top of wallet.

Chase Sapphire Reserve Initial Bonus Offer

They’re offering a generous 50,000 point signup bonus (after $4000 spend within 3 months of account opening). There hasn’t been a better offer since the card first launched in fall 2016.

Earn Rewards Quickly For Your Spending

This card earns triple points on travel and dining, and 10 points per dollar with Lyft (one point per dollar on everything else). Lyft earning stacks with what you can earn on Lyft rides with Delta and Hilton.

Travel and dining is most of what business travelers put on their cards, and it’s what leisure travelers spend on when they travel (no foreign transaction fees helps use the card abroad too). The travel category is broad as well:

Merchants in the travel category include airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, travel agencies, discount travel sites, and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages.

You can take your points and transfer them to a variety of airlines and hotel programs, or use your points at 1.5 cents apiece towards any paid travel available through the Ultimate Rewards portal.

- Airlines: United MileagePlus, British Airways Executive Club, Air France KLM Flying Blue, Singapore Airlines KrisFlyer, Southwest Airlines Rapid Rewards, Virgin Atlantic Flying Club, Iberia Plus, Aer Lingus AerClub, Emirates Skywards

- Hotels: World of Hyatt, Marriott Bonvoy, IHG Rewards Club

Singapore Airlines

Priority Pass For Airport Lounge Access

The card comes with a Priority Pass Select with unlimited visits (including for up to 2 guests) subject only to capacity at 1000+ lounges around the world. And unlike American Express, Chase does not exclude participating airport restaurants from the benefit.

Priority Pass Select is a card that gets you into lounges around the world. You don’t have to belong to an individual lounge program, this program works to have lounges in most of the places you go.

Additional cards on your Sapphire Reserve account cost $75, and those are eligible for Priority Pass as well. So your family members can have lounge access when you’re not with them, too (and their spending can rack up your points balance faster).

I especially love all of the airport restaurants that take Priority Pass and give you a $28 (for you, $28 for a guest) credit to spend. American Express-sponsored Priority Pass cards don’t get this benefit, but Chase Sapphire Reserve-sponsored Priority Pass cards do.

And it’s not just lounges and restaurants, Minute Suites is a great option for a private room with daybed and desk in several airports too. I’ve made great use of them in Philadelphia and in Charlotte during my layovers when the American Airlines club just won’t do.

Sapphire Reserve Annual Fee and Valuable Credits

Sapphire Reserve Annual Fee and Valuable Credits

The card has a $550 annual fee. That’s comparable to Amex Platinum, but Chase has a $300 travel credit that lets you buy any travel, whether airfare, hotel, or even just Uber while the Amex $200 fee credit is limited to airline fees on one airline you designate for the year.

Citi Prestige has a $495 fee, with a $250 travel credit, for about the same net cost. Both cards offer Priority Pass Select cards. Citi, however, has eliminated travel protections like trip delay and baggage delay coverage.

Many readers consider whether the card is worth $250 a year net of the travel credit. Bear in mind you also receive:

- Up to a $100 application fee credit for Global Entry or TSA Pre✓®

- One year complimentary Lyft Pink membership ($199 minimum value)

Travel Protections

Citibank and Barclays have generally eliminated these protections from their cards. American Express now offers a limited number of protections on certain cards. But Chase is the gold standard here for rich rewards cards with travel protections. Most people gloss over these, which is why they can offer rich benefits like these, those who know about them really benefit while it costs little to fulfill for most people.

- Primary collision damage waiver for rental cars decline your rental company’s collision coverage and you get up to $75,000 in coverage — so if you ding the car your own insurance may not even need to know.

- Baggage Delay if your bags are lost for more than 6 hours you can get up to $100 a day for 5 days reimbursed, save those receipts for purchases of essential items.

- Trip Delay Coverage if your flight is delayed more than 6 hours — or overnight — you get up to $500 per ticket in expenses like hotel, meals, and ground transportation.

- Trip Cancellation or Interruption if it’s a once in a lifetime trip you couldn’t replace you may still want trip insurance, but you can get reimbursement up to $10,000 for trips cancelled or ended early due to sickness, injury, and other covered events.

There are other benefits too like medical evacuation (one reader’s father had a quarter million dollar expense covered by American Express).

There’s even a roadside assistance benefit covering a tow, locksmith, gas, tire change, or jump start up to 4 times per year, up to $50 each time.

Additional Sapphire Reserve Card Benefits

On top of travel protections there’s also purchase protection and return protection providing up to $10,000 in coverage for stolen, damaged or lost items within 120 days of purchase with the card and up to $500 per item ($1000 per year) when you’re dissatisfied with a purchase and the seller won’t take it back within 90 days of purchase. (There are certain exclusions such as items purchased overseas and you do have to return the item to Chase as part of the claim.)

This is a nice-feeling metal card. And it’s a Visa Infinite, which gets you benefits like 20% off Silvercar car rentals with promo code VISAINF20.

Combine Points From Other Chase Cards Into Your Reserve Account

Chase offers several cards that bonus different categories of spend – including no annual fee cards. If you pick up a no annual fee card, the points from that card won’t transfer to airline miles.

However if you have a Chase Sapphire Reserve card you can move the Chase Ultimate Rewards points earned on other cards into your Sapphire Reserve account. Then those points transfer to airline miles or hotel points, and can also be spent directly on travel through Chase’s portal – at the elevated 1.5 cents per point value that you only get with a Sapphire Reserve card.

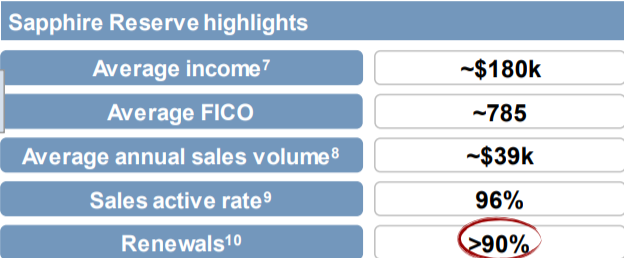

Who Are Sapphire Reserve Cardmembers?

After the card had been in the market a year Chase revealed some data about Sapphire Reserve cardmembers.

Getting Approved For the Chase Sapphire Reserve Card

In order to be approved for this card you need to have gotten fewer than 5 new cards in the last 24 months. In other words, Chase Sapphire Reserve is subject to “5/24.”

In addition you can only have on Sapphire card at a time. If you have a no annual fee Sapphire, or the Chase Sapphire Preferred Card, you would need to either give up that card before applying for this one or request to product change your existing card to Reserve.

Chase will only give you the bonus on a Sapphire account once every 48 months. So if your existing (or last) Sapphire received a new cardmember bonus less than 48 months ago you’re not yet eligible for a bonus on this one.

Judging from the people I see pulling out the Chase Sapphire Reserve Card it’s not a difficult product to get though some readers have reported challenges. As a Visa Infinite card it’s not for approval with low available credit. Applying for a Chase Sapphire Preferred Card can actually be a good strategy for getting Sapphire Reserve. If you get a Preferred and then wait a year you can request to product change to Reserve.

We get an article about the Chase Sapphire Reserve from Gary… now that they have raised the annual fee, they must be giving decent commissions on sign-ups again…

September 2019: “Chase Sapphire Reserve has become passe”

January 2020: “Apply for Chase Sapphire Reserve!”

May 2018: “I don’t get it, why are people still collecting Skymikes?”

January 2020: “Apply for Amex Delta Cards, highest Sign Up Bonus Ever!”

For what its worth, I think your January 2020 posts are the right ones and the prior posts were a bit off, not the other way around

You bloggers have never met a credit card you don’t pimp so long as they offer a referral bonus.

BE aware that I have this card – and the travel insurance benefit is useless.. when the US and the world cancels travel into China – and you have nonrefundable hotel reservations – this insurance is not covered – it’s basically worthless then.

@Spike, complain on Facebook, on their web site, everywhere you can. That’s ridiculous. If you can’t get there, you can’t stay in the hotel.

You also failed to mentioned that Chase just recently and *quietly* removed financial insolvency/bankruptcy from the covered reasons for trip cancel/interrupt! Kind of a huge deal-breaker…