I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Update 12/1/22: Bask Bank Mileage Savings Accounts now offer 2 American AAdvantage® miles per $1 saved annually.

![]()

I’ve been a Texas Capital Bank, N.A. customer since July 2003 when I opened my BankDirect online checking account. Through BankDirect I’ve earned hundreds of thousands of American Airlines AAdvantage® miles.

Texas Capital Bank, N.A. has now launched Bask Bank offering online savings accounts that earn American Airlines AAdvantage® miles. Many of you will earn more miles saving than you will spending whether it’s spending money on a credit card or through an online shopping portal.

This is a great way to save money, a great way to earn miles, and there are lucrative bonuses for opening a no fee account and getting started now.

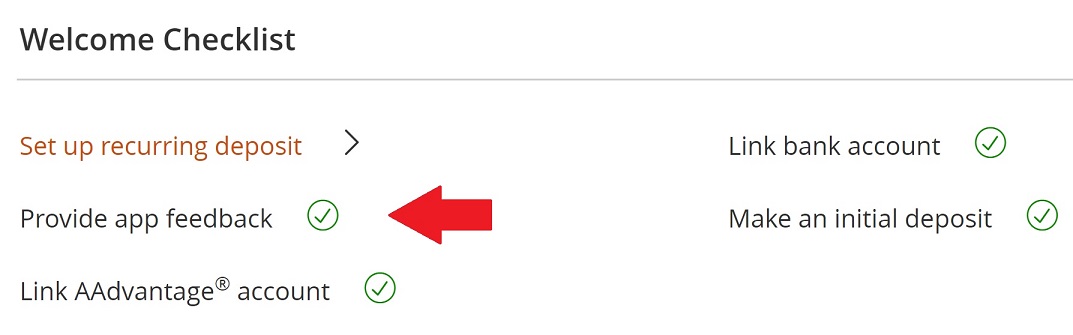

Screen shot, Bask Bank

Sign Up Is Free, Quick and Easy

I’ve already opened my own account. It’s free and quick and I’ve already seen miles post to my American Airlines AAdvantage® account. It was a no brainer for me since I’ve been a customer of the bank for over 16 years and it cost nothing to do it.

In fact it took me less than 5 minutes to get the account opened. There is no hard credit pull when opening the account. It has no fees. And there’s no cap on the account balance they’ll award miles for.

They’ll let you link an outside account and transfer money right away. There’s no commitment for how long you leave money in the account, though I’m going to suggest it’s valuable to deposit money and leave it there both for the ongoing earning and to earn some bonuses too.

Your money is FDIC insured. Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. The sum of your total deposits with Bask Bank, BankDirect, and Texas Capital Bank, N.A. are insured up to $250,000.

They’re not asking to be your main bank, or get you to move over your banking relationships – just to use them strategically to get the best deal possible.

1000 Fast Miles Without a Deposit

For a limited time Bask Bank is offering account holders 1000 miles just for completing online feedback within 60 days of opening an account. This offer requires you to open an account by April 30, 2020 and provide feedback by June 30, 2020, as well as provide your AAdvantage® account number within 60 days of opening your account.

I opened my account and hadn’t even funded it yet. I shared a sentence or two about the process, and 1000 miles hit my account within 48 hours. I was impressed. (They say it can take up to 10 business days.)

If nothing else, sign up with Bask Bank right now and give them feedback. The whole process takes minutes and you’ve got 1000 American Airlines AAdvantage® miles without spending money or even transferring money.

5000 More Easy Miles

Once you open an account though you’re going to want to transfer money into it. That’s because as long as you open an account by February 29, 2020 and provide your AAdvantage® account within 60 days of account opening then a $1000 deposit into the account held for 30 consecutive days within 60 days of account opening will earn another 5000 miles – that’s on top of the miles you earn from your account balance each month.

This is another good reason to open an account now, since the initial $1000 deposit bonus (for holding the balance for 30 consecutive days, within 60 days of account opening) drops to 1000 miles for accounts open March 1 – June 30, 2020.

And You’re Going To Want To Keep Earning

You earn 1 mile per dollar saved annually. If you have a $60,000 average balance in the account you’re going to earn 60,000 miles for the year. Mileage-earning is paid out monthly so that’s about 5000 miles per month (months with 31 days in them will earn a few miles more, months with fewer days will earn a bit less).

No Caps On Earning, They Even Bonus Big Balances

If you deposit large amounts into the savings account within 60 days of opening, and leave the money there for 360 days, you’re going to earn big bonuses in addition to the normal miles you earn for your average balances (and in addition to your account opening bonus where you can earn 5000 miles, and in addition to being able to earn 1000 more miles right now for giving feedback to the bank).

- Maintain a $25,000 balance for 360 days, earn 10,000 bonus miles. They’ll pay out 5000 miles after 180 days, and the other 5000 miles after 360 days.

- Maintain a $50,000 balance for 360 days, earn 20,000 bonus miles. They’ll pay out 10,000 miles after 180 days, and the other 10,000 miles after 360 days.

- Maintain a $100,000 balance for 360 days, earn 40,000 bonus miles. They’ll pay out 20,000 miles after 180 days, and the other 20,000 miles after 360 days.

Accounts must be opened by March 31, 2020 to be eligible. It’s possible to qualify for different bonus tiers if your deposit level changes. So you might qualify for the top tier over the course of the first 180 days, but if you withdraw funds during the second 180 days you might then qualify for a lower tier.

If you open an account now, deposit $100,000 miles in your account right away, and leave it there for 360 days (and give feedback to Bask Bank after opening, too) then after a year you’ll have earned 146,000 miles:

- 1000 for feedback

- 5000 for first month’s balance

- 100,000 miles based on your average balance

- 40,000 more miles for the 12 month bonus

That’s Enough Miles for A Business Class Award Ticket Almost Anywhere In The World

American’s partner award chart allows you to book business class awards roundtrip almost anywhere in the world for 140,000 miles (Africa is 150,000 miles roundtrip, South Pacific including Australia is 160,000 miles so you’re almost there, too).

You can travel to the Mideast, India, or even the Maldives flying Qatar Airways QSuites business class both ways for 140,000 miles.

Qatar Airways Business Class, credit: Qatar Airways

You can travel to Bali on Cathay Pacific via Hong Kong in business class both ways for 140,000 miles.

Cathay Pacific Business Class

As long as there’s saver award space available your savings account can take you almost anywhere you’d want to go in comfort.

How Much Are All These Miles Worth?

I’ve publicly valued AAdvantage® miles at 1.4 cents apiece. So I view earning one mile per dollar (without factoring all of these bonuses) as being like earning 1.4% on a savings account.

The week of December 9, 2019 the FDIC reported that the average rate on a savings account was 0.09%. I view Bask Bank, then, as being over 15 times better than that.

If you earned 146,000 miles, as in my example above, that would be worth $2044, or a 2.04% rate of return (which includes Bask Bank bonuses). That’s better than you’re going to do, even, with high yield savings accounts – which may even cap the amount of money they’ll pay out premium interest on.

And that’s before we even talk taxes.

- Bask Bank’s terms and conditions say “[m]iles are currently valued at 0.42 cents per mile, the equivalent of 0.42% annual percentage yield.” Assuming that doesn’t change over the next year, earning 10,000 miles would generate a 1099 tax reporting form showing a value of $42.

- If you value 10,000 miles at $140 as I do, and pay taxes on those miles at $42 with a hypothetical income tax rate of 32% you’re paying $13.44 in taxes and netting $126.56.

- Forget the average 0.09% that savings accounts pay, let’s assume you could earn 1.8% in a high yield savings account. That’s $180, on which a 32% tax rate would be $57.60, for a net of $122.40.

Bask Bank is coming out ahead of even high yield savings accounts in this example.

Bask Bank Wants Our Business

They tell me they’re “here for the life maximizers” and they know that people who play the miles and points game are “rational, affluent and successful.” We’re the customers they actually want, because we value frequent flyer miles. They don’t have to do a lot of convincing that they’re offering a useful value proposition. We already know what we can do with the points.

@ Gary — You can get 2.25% taxable elsewhere. Bask’s sweetened offer is possibly slightly better.

@Gene, @ Gary–basically, we are comparing the value of the award ticket against the ROI.

So in Gene’s scenario with 100k at 2.25%, as long as the award ticket has a personal value of greater than $2,250- to the user, it’s a deal. If I were to invest that 100k in a stock paying dividend of 5%, then I would have to ask myself if an award ticket “experience” in F or J is worth that 5k cash I would be losing by investing in Bask Bank vs. a stock.

Still, a great way to accumulate some points, even as a secondary savings account.

I am assuming you don’t receive a 1099?

I am getting 1.85% APY at Ally Bank, taxable, so this could be interesting with the bonus after a year, despite having over 1m AAdvantage miles. My last flight in Business Class on AA 787-9 was really great, a surprise.

Gene, where are you getting 2.25%?

Seems right off the bat they are offering better terms than their old BankDirect product with no $12 monthly fee. Any reason we shouldn’t close that account and transition to the new Bask Bank product instead? I imagine they are trying? to completely cannibalize their old Bankdirect product, no?

I see no mention in the terms of the 40,000 bonus for 100,000 average balance. Where did you see this offer?

This actually seems really cool, a great easy way to earn a lot of miles. Thanks!

@John – bank terms and conditions

@Rob I have a BankDirect checking and I have direct deposit set up with it, I use the account and earn miles for checking. I don’t think you can open a new BankDirect checking that earns miles anymore, I want to preserve mine. Though full earning on the account is capped and it has a monthly fee, the full earn rate is slightly higher than with the savings account.

@Frank – I mentioned the 1099 and how their terms and conditions explain that they are valuing miles in the post.

@Gene – 2.25% uncapped?

Before Dug Parker ruined American Airlines and the value of its Mileage currency

I would have put 100k in as I had before

But American with their 400 to 500 k one way awards and horrible food and atrocious customer service these days leaves me happy to earn 3.5 per cent in cds and 2 percent of slightly more in liquid accounts

Cash is king because American is a bad company

Hope one day a new CEO can save the company however it’s so badly damaged I doubt it

I have a savings account with HSBC Direct at 2.05%. That seems to pay better than getting AA miles. However, the bonus structure is interesting.

Thanks for the post, Gary. Seems like this is, by a meaningful amount, the cheapest way to “buy” AA miles

1) In this example, you basically forgo 2% interest on a no penalty CD. Assuming you deposit $100,000 for the year, you pay roughly $1,556 for 146,000 miles ($2,000 in lost interest, less 32% taxes, plus the 32% tax you pay on the 1099 value of the miles). That is about 1.07 cents per mile

2) Alternatively you could spend $100,000 on an AA card on unbonused spend. You get 100,000 AA miles and forgo 2% cash back – so you pay 2 cents a mile. Assuming you spend $50,000 on bonus categories on AA cards, you then can knock it down to 1 cent per mile

3) You can buy AA miles at a minimum about 1.7 cents per mile outright (more likely well above 2 cents if you don’t buy the max).

I will sign up. Great stuff

Gary – bonuses are on page 32 of the terms linked on your post, and only mention 5k opening bonus, 1k feedback bonus, and 20k balance bonus (50k balance). I see no mention of a 40k bonus on 100k balance or 10k bonus on 25k balance. Am I missing something?

This is certainly a solid offer, and better than what BankDirect has been offering. I would also note that it’s considerably more fun to earn frequent flyer miles than tiny amounts of interest, so I’d personally factor that into the equation as well.

That said, it’s very generous to value AA points at 1.4 cents. If redemption was easy, they would be worth that. The problem is that redemption is not easy, and one should realistically devalue the miles to reflect that reality. If I were allowed to sell my AA miles for 1.4 cents for cash, I would do it all day long. As would most people. I think 1.1 to 1.2 cents would be a more accurate valuation where there would be as many people buying as selling (excluding the folks who are looking for biz class seats on partner airlines).

Your screenshot shows you earned a bonus for “app feedback.” I think you opened this without an app though. Is that correct?

No interest and you get taxed on the miles? Pass. At least cash earns interest. While there’s still some value to be found on American, mostly through partners, they’ve been slowly destroying AAdvantage since Parker showed up. That makes cash proportionally more valuable than AA miles.

I only see mention of a $50,000 balance bonus. I am willing to put in more, but do not see any mention.

Ditto

@ Gary — Yes, but the rate is only guaranteed until 6/30/2020 and then the rate could drop (true of any bank). See https://www.customersbank.com/ascent/

To those asking about the $100,000 bonus, here is the link to the tiered bonuses:

https://www.baskbank.com/bonus-miles-terms-and-conditions

@ KimmieA — Right, since stocks ONLY go up in value. Roll eyes.

@Gene – I see they have a $25k minimum balance to earn that rate

Banks have been borrowing (our) money from the Fed for nothing. And they’ve been paying depositors minuscule rates on deposits. Pretty good deal…for banks.

Now they have products that pay depositors *nothing* except the promise of airline rewards points? An even better deal…or the banks.

@ Gary — Correct, but you asked about caps! 🙂

Did they eliminate the monthly fee Bank Direct was charging?

Aren’t we really comparing to a 6 or 12 month CD rate, or are miles pro-rated to the date of withdrawal?

I get an uncapped 2.75 on free cash (not publicly available) so I think I’m better off paying taxes rather than earning miles.

Didn’t AA’s credit union used to offer miles AND interest?

https://www.flyertalk.com/forum/31814319-post2172.html

@ rrgg — Thanks for the spreadsheet. You saved me 15 minutes of Excel work. This proves that Bask’s offer is a worse deal than 2.25% taxable. However, it is highly dependent upon one’s tax rate. The Bask deal gets better the higher your tax rate. The AA deal gets better the more highly you value marginal AA miles. I think I will pass for now.

Can you fund the Bask account from a BankDirect account (essentially transferring from one product to the other) and still get the bonuses?

Enough to pique my interest, but not enough to match interest in some high-yield checking accounts that are earning 3% or 3.3% with limited monthly activities. Given that one of them has just gone down from 4% to 3%, if it were to drop to under 1.5% with current interest rates, this would be a good place to park. In for the $1000 minimum signup bonus.

Looks like Bask Bank isn’t yet on Mint …

I opened a Bask account early last week. I initiated a transfer of $1000 into Bask Bank on January 7. My $1000 left my other bank on January 8. My $1000 is still not in my Bask account. Yesterday, I called Bask and they promised me it would be in my account on today. Since my $1000 is still not in my account today, I called in and was told it will be there tomorrow.

This bank has lost my trust, and I can not recommend Bask to anyone.

Tell me, I’m a non-resident. Is this available to me? I’m very interested in your article!

One thing to consider is that unlike interest, your points won’t compound. So you are actually giving up a pretty substantial amount as time gets longer.

Don’t make my mistake. I tried using the same user name and password with Bask Bank as I used with BankDirect. Process died in the middle of the application with the account placed in limbo (initial deposit was also cancelled). Needed to call in to straighten it out. They also can’t handle joint accounts yet (as of a week ago) or contingent beneficiaries. New IT which is why they are paying 1000 Aadvantage miles for feedback. Having said that, my total AAdvantage earnings with BankDirect just topped a million miles, so I’m in on Bask Bank too.

Just be aware that the miles/points earned from a bank account are taxable, and the bank is obligated to send you a 1099 at the end of the year. I was a Bank Direct customer and received a letter to that affect. I closed my account immediately.

Normally I say it’s not worth it to give up high yields. But with the bonus points, and given that there are no transferable points to AA, and given that I justed used up all my AA miles, it’s worth it to me. Any idea if and how they would value these for taxes?

Lifetime Gold member with half million miles which are useless being American has pretty much abandoned the NYC market. The US Air merger has been a disaster for AA and their program.

Since AA started offering their “Economy Web Special” awards starting at only 5K miles o/w, and even more so since they recently dropped their close-in booking fees, AA miles have become much more attractive to me. I’ll be opening new accounts with $1K for each of the 6 members of my household, after 30 days I’ll reevaluate. Easy 6K miles per account.

Still waiting for them to approve me for a account. It’s been almost 3 weeks. Can’t even get a account started yet….

You made opening an account sound very easy and quick. I filled out the application online and received a message they need additional information to complete my account. I’m supposed to send an email to their support team. Seems a bit shady, so I’m not going to provide them any more info. Shouldn’t they be contacting me via email as to what further info they need?

Bask Bank apparently can’t be added to my Mint account (??)

To earn 1 mile /month, for the keep alive purpose, what is the balance amount needed?

There are a slew of banks offering 3% for no-fee checking accounts – usually limited to $15-$25K per account. Go read Doctor of Credit’s site for the list. Most have requirements to log in to your account a few times a month and 10-12 purchases with a debit card. I have 8 accounts with about $150K of combined emergency cash deposits. Way better than getting AA pesos.