Chase is considering a new premium United MileagePlus card. It may be mid-market, something with a $250 annual fee, rather than an ultra-premium card that includes club lounge membership.

This is all part of trying to figure out what to do with the United portfolio which is underperforming and United isn’t happy with the revenue they’re earning.

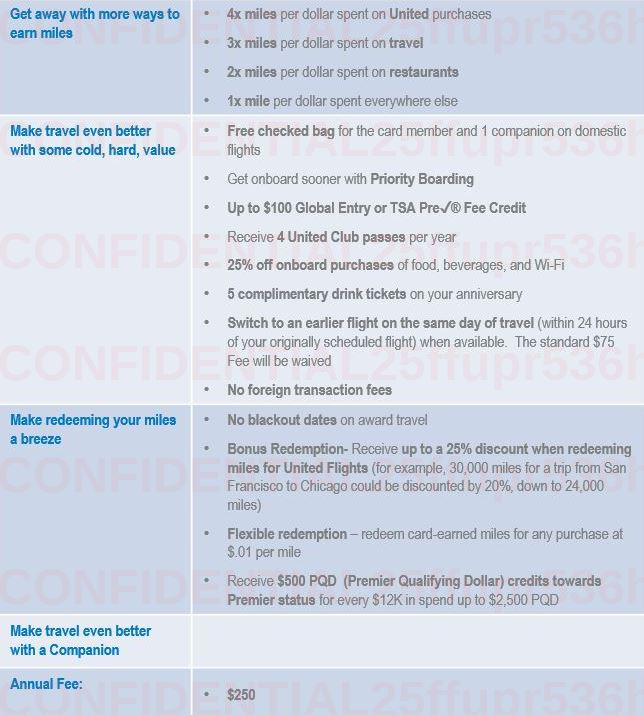

Here’s one value proposition being surveyed:

Potential to Gut the Spend Waiver for Elite Status

Currently $25,000 spend in a year on a United credit card waives the airline’s minimum spending requirement for elite status up to the Platinum level (there is no waiver for US-based customers earning 100,000 mile status).

What’s described here is 500 qualifying dollars per $12,000 spend up to a maximum of 2500 qualifying dollars after $60,000 spend on the card. That’s shockingly bad since the lowest Silver status requires 3000 qualifying dollars. The only redeeming feature would be that presumably these dollars would count towards 1K.

It’s almost like they watched American gut the ability to earn qualifying dollars through spend, requiring $50,000 spend in a year for 3000 qualifying dollars and Andrew Nocella said “hold my beer.”

We’ll Restore Award Chart Pricing If You Pay Us a $250 Annual Fee

The notion of a 20% redemption discount for United Airlines travel is intriguing until you get to their example of a domestic 30,000 mile trip being reduced to 20,000 miles. It’s also like United said “we’re eliminating award charts and raising prices but will give you an actual saver award if you take our $250 card.”

Yet this is probably the best feature of the product if the discount isn’t capped (since you can earn Chase Ultimate Rewards points, transfer them to United and get a perpetual transfer bonus as long as you restrict redemptions to United travel).

Many of the Benefits Would Be the Same

Free checked bag, early boarding, TSA PreCheck or Global Entry credit (which is cheap to offer because most people don’t claim it and it’s offered no more than once every four years), and United club passes.

United Explorer today comes with 2 annual club passes but many clubs do not take them because they’re too busy and prioritize those with memberships. Apparently while the graphic says 4 passes, survey questions mentioned 2 passes.

Potential Additional New Benefits

Five drink chits a year are fairly pedestrian when over at American the Aviator Silver card gives a $25 inflight purchase credit every day.

A waived fee for same day flight change is nice but you aren’t getting outsized value out of it unless you’re flying enough to earn a status that waives the fee anyway.

Is This Card (Enough of) an Improvement?

Faster mileage-earning is good but the earning rate isn’t enough to make the card compelling for spend. After all you can earn this many miles in a flexible points currency that lets you choose where to put those points later, including through Chase Ultimate Rewards which gives you United miles or another airline’s miles and you get to pick later.

The 20% redemption discount is interesting, American just dropped their 10% (capped) discount from their cards.

It could be well worth upgrading from a base United Explorer to this card — but wouldn’t be worth spending money on this card over more compelling alternative transferable points products.

Nonetheless it will be interesting to see what they ultimately come up with. I expect a new British Airways card proposition from Chase soon-ish as well by the way.

I took the survey. I mentioned the earning wasn’t competitive. I also mentioned with recent devaluations I don’t want to collect United Miles as munch anymore.

Rip off, it’s effectively $100 more than the Reserve card for extra earning on UA purchases and “COULD BE UP TO 20%” back in miles, no thanks. Only with it if you have no UA status and change flights alot

I’m through collecting United miles. I don’t care how many bonus miles they throw at me. They keep being worth less and less and they’re already pathetic.

So with the existing United Explorer card I on occasion will see XN inventory that isn’t available to others…will I get 25% discount on those fares or will this 25% be basically replacing that and I’m just booking YN inventory all the time for the existing XN price?

Seems like it’s not adding much value if that is true. Yeah, XN inventory isn’t always available, but for a vacation I’m willing to search for it…

Well… as others have said, removing the award charts is the kiss of death for loyalty program engagement. Sure, the programs are usually spinning this as a way to make coach tickets a little cheaper (and *lots* of people want coach redemptions, I get that) but with the award chart gone, the program switches from chasing a dream to a mere rebate program. The later is a cost center. How so? Because if I don’t know how much an award is going to cost me, it doesn’t change my behavior. I do what I’m going to do, and if I have enough points for the award, so be it, and if I don’t, I don’t.

Contrast that to an actual award chart, where if I have 75,000 miles in the bank and I need 80k for the award, I may buy miles, put extra spend on the card, take some revenue trips that I may have given to another carrier (or not taken at all).

Case in point: I buy WN tickets once a year (like clockwork) for turkey day travel. They are the only nonstop option in this market, and paid tickets haven’t been cheap for the last couple of years — double the price of non-holiday travel. So I buy them no matter what. Well, this year, I actually had enough points for a one-way ticket, so I redeemed them! But this was purely a cost center to WN, because I would have paid for the ticket had I not had the miles, and the program didn’t motivate me to change my behavior to earn the miles.

@ Gary –Yawn. This won’t help United’s problem with its crappy credit cards.

The PQD waiver is basically the only reason I keep the Explorer Card and do any spending on it rather than 100% on CSR. If that waiver is eliminated for this inferior option, I’d have no reason to keep the Explorer card any more.

BIG YAWN

UP TO 25%? 0% meets this criteria. They’ve got to be kidding. So we should jut trust that United that this will be meaningful? I think the air is getting a little too thin at United HDQ at Willis Tower. The only thing we can count on from United is that they currently researching more devaluations that they hope to implement in the years ahead.

I will keep my UAL card for the extra availability and bags if I ever fly United but as for spend, Amex or Chase points have way more value.

@dan hits it right on the nose.not having a target has taken away the incentive. I used to use United’s shopping portal but I’ve even moved my spending to Ebates how the have Amex points.

@Gary, it’s like @Scott said–the CSR comes with a plethora of be benefits, including lounge access, and all for (effectively) $100- less. Why would I want this card?

I do have a friend who flies United 3x a year, r/t, with her daughter, in economy. She has the United Explorer card, which she loves. I talked her into the CSR, which she tried but eventually cancelled; she doesn’t care about lounge access nor the option for Rewards point use on a myriad of different airlines. She’s the type who might jump at this new UA card–not because she has status with UA, but because she likes United becasue she has flown it since a child. Kinda like those Apple fan-boys (nothing against them, I use Apple products, too!) who will continue to stick with a particular brand despite its obvious shortcomings.

If the spend waiver is eliminated that will also end my use of my United Chase card and any relationship I will have with Chase. My card use always exceeds the amount necessary to obtain the waiver. I am a leisure traveler and normally have miles for gold and occasionally platinum which is good for overseas travel and access to lounges.

I’m in Denver so Star Alliance is still my best, and sometimes only, choice. I do about 100k miles a year to DC, South America and Europe. I don’t care about earning miles since the company buys business class but I would like to keep 1k if for no other reason than being able to board early on those South American flights where everyone in economy jumps in the Group 1 line carrying 5 bags about an hour before a flight. I will make my 100k miles this year but not the pdq. Once United changed the dollar requirement and I realized I wouldn’t make it, I started buying most of my tickets (code share) via partner airlines – sometimes at a 50% discount to what United was charging on their website – for the exact same flights!?!

I would pay a grand or even a couple grand a year for a card that gave me a legitimate way to earn 1k. Maybe a card that eliminated spend requirement for 1k after a certain spend on the card. I don’t care about the free bags, priority line, special call numbers, etc since I’m in business anyway. Actually, now that I think about it, screw a card – I hope United starts selling a pre-board upgrade option like they have everything else. I’d pay $50 to board with the 1Ks.

Anyway, I’ve had too much coffee and nothing to do so sorry for my non-directed rant. Just seems like airlines are doing everything they possibly can to make sure you aren’t loyal anymore. That has to be a win for discount airlines but since United is almost never the cheapest you would think they would have cards and a program gave you a reason to be loyal.

I was expecting these extra minor perks for my standard United Explorer card. If they expect me to pay $250 for it… I say no thank you. Far better is to cancel the standard card, wait a month, and reapply for it to get the sign on bonus. The 40 to 50k bonus is far better than the additional crumbs they plan on offering for $250 extra.

I have a CSR and the United Club card. With the recent devaluations and the loss of the GF cabin making it very difficult for me to redeem United miles at the saver rate for premium cabin seats, I’m happier using Chase UR points to purchase discounted business seats on United. It’s frustrating that this means I lose the ability to make changes for little cost, but it does at least get me into the premium cabin on my transatlantic flights.

The main reason I still keep the United Club card is its purchase price protection. I use this card for unbonused spend. This may seem wasteful, but the purchase price protection has been valuable to me (I recently got a $500 rebate on a mattress, as an example). 1.5 United miles per $1 spent + purchase price protection is okay. If I could get purchase price protection with a decent rebate on a more fungible currency I would switch to that, but for now, this looks to be my best option. I’m just resigned to using these United miles for cheap domestic flights. If/when purchase price protection is dropped from this card, I’ll be looking for a better earning option for my unbonused spend.

United 1k here and have no United card. CSR and Amex Plat.

Want to make it compelling , really want me and others to switch and pay a premium – 5x miles on United flights and opportunity to earn PQD.

United clubs are a joke as would rather sit in terminal than fight for a seat and a cube of processed cheese

Too much spending for too little PQD. They should just abolish the PQD requirement – if it effectively makes a segment less loyal it’s not having the desired effect

I love the “no blackout dates on award travel” so-called benefit…quite the euphemism for variable pricing

UA shot itself in the foot when it destroyed the award chart and eliminated J saver awards. Bye bye, it’s off to AA to fly Qatar.

None of it wil do any good to most of us in any case with 5/24 in force.

Free checked bag benefits for domestic flights is not the same to what currently is offered by the Mileage Plus Explorer Card. The Explorer Card offers one free bag for all flights, not just domestic (which is a more better value proposition).

They should offer alt benefit if you have status that gives you free bag and priority boarding.

United has to address redemption values of MileagePlus to make the card’s improvements in earning worthwhile.

Unless someone has an excess supply of points, why would they opt to earn/redeem United MileagePlus instead of World of Hyatt points? Hyatt redemptions are reliable/available/efficient and usually worth much more.

Every time these airlines boost their cards’ earning rates and sign-up bonuses, the supply of points goes up and the airlines eventually devalue to protect the revenue from competing cash fares. Somehow “tricking” the consumer into earning more of a currency that is harder to use and worth less is not sustainable in the long run.

I think United misses the big picture here that earning Chase UR points is more rewarding even if they’re ultimately transferred and redeemed as United MileagePlus miles. Chase’s UR program provides stability for the consumer. The program’s shopping portals and diverse transfer partners lessen the impact of devaluations and inventory shortages. Chase provides their customers a reliable and reasonable return on their spend. United does not.

The formula is simple:

– Does the airline want a lot of retained cardholders? Offer benefits the cardholders value.

– Does the airline want the cardholders to spend? Offer reliable and valuable redemptions.

The UA cards are totally unattractive for frequent flyers because:

1. MP elites already have free baggage (Silver and above), priority boarding (Silver and above), drink kits (1K and GS), same day change waiver (Gold and above) and the elite award spaces. So why would they want to give up the higher values of CSR spents for these pseudo perks that are worthless to them?

2. The upper eilts (1K and GS) tend to be higher spenders. They tend to have more UA RDMs in their account already. They are far less interested in getting more UA miles than MP members of lower status, especially that the fixed reward table is now removed. For them, UA miles are the least attractive compared to flexibility of other air and hotel programs that CSR and AX offer.

UA needs to offer useful values to higher elites, not the useless ones that they already have. One way to do this is to offer higher payoffs on spends. For example, 4X RDM purchasing UA tickets for Silver, 5X for Gold, 6X for Plat, 7X for 1K, etc.

I’m with @Jeff. There’s a really simple way for United to get people to sign up for and use their card: offer value. This is not a difficult concept, Scott Kirby.