I receive compensation for content and many links on this blog. Citibank is an advertising partner of this site, as is American Express, Chase, Barclays and Capital One. Any opinions expressed in this post are my own, and have not been reviewed, approved, or endorsed by my advertising partners. I do not write about all credit cards that are available -- instead focusing on miles, points, and cash back (and currencies that can be converted into the same). Terms apply to the offers and benefits listed on this page.

Chase revealed several interesting facts about its credit card business in an investor deck (.pdf) this week.

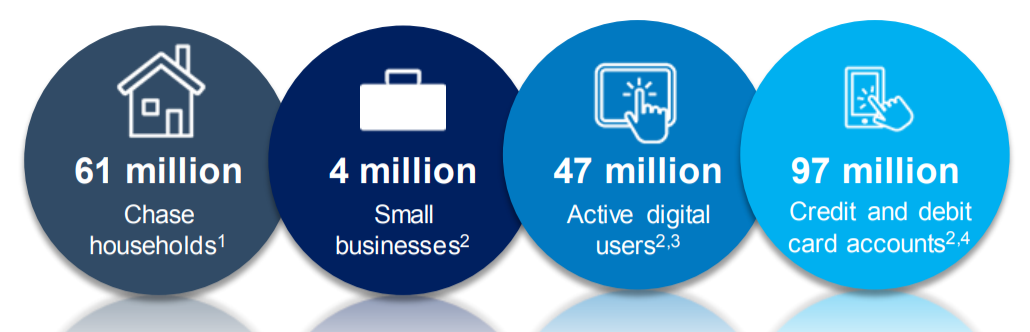

They do business in some form with 61 million American households (~ 50%) and have 97 million credit and debit card accounts.

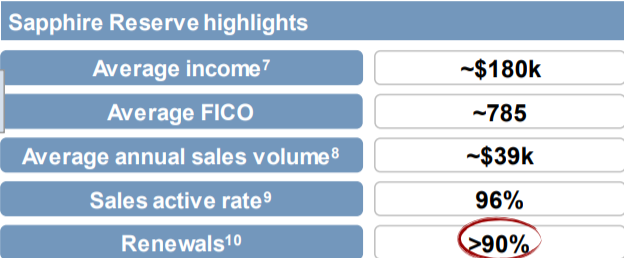

Chase invested a ton in the new ‘it’ card in the rewards space. And they’ve now got good numbers on how Chase Sapphire Reserve is doing.

- Here’s my review of the card

- The 17 features I like and 9 lesser known benefits

- Benefits for authorized users

While the average FICO score is 785 that means many cardholders have lower scores, just as they have higher scores. Annual spend of $39,000 sounds high but equates to $3250/month, not low but not as intimidating.

I’m intrigued that 90% of users are keeping the card after the first year. That’s an incredible retention rate. It does makes sense to me from a value proposition standpoint — people who spend regularly on travel and dining make out well with the card even compared to the Chase Sapphire Preferred Card‘s double points in those categories, and that’s without even valuing airport lounge access. However I’d note that this data reflects the earliest adopters of the card only, they don’t yet have a year of data on this decision.

Chase is investing a lot in its digital experience because they believe a large portion of customers will leave a bank that doesn’t do a good job there, and will choose a bank based on a superior mobile experience.

That’s not just true for millennials either, their data suggests 85% of wealthy use mobile apps. And not only is it important to attract and retain business but it lowers the bank’s costs as well.

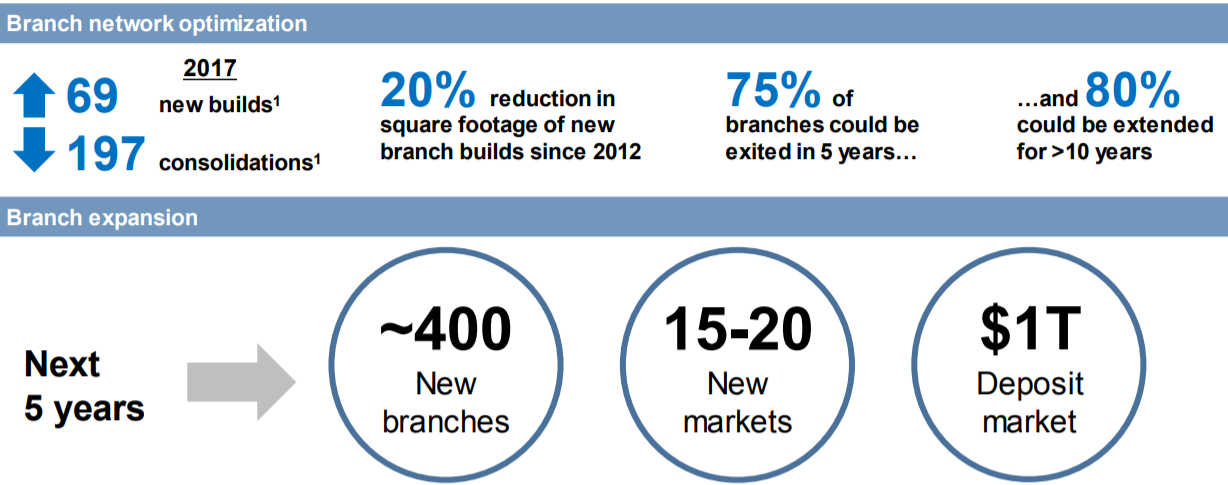

With consumers’ mobile emphasis Chase is closing branches, operating smaller branches, though at the same time they’re opening new branches to expand their footprint in to markets where they aren’t yet strong.

Chase used to view the branch as key to their client portfolio, it’s how they cross-sold customers so that a checking customer became a credit card customer and a mortgage customer. They now see digital as a tool here, and have had some initial success offering Chase Sapphire Reserve customers mortgages (Chase had the best deal for my mortgage last year, and they had stackable promos for a discount and 100,000 points that were added sweeteners) and even turning cardholders into wealth management customers.

(HT: Doctor of Credit)

@Gary: How much of the new card issues do they attribute to your site? My guess would be about half.

In the Midwest, Chase is closing the supermarket branches that it received from buying BankOne. Chase doesn’t even leave an ATM. Which is crazy, because the customers, need a place to get cash and make deposits. Instead, we have drive 20 miles to another branch, or pay ATM fees to use another bank’s ATM. Chase also used to have ATMs in many Walgreens. They removed most of those, 5 years ago. Chase can rave all it wants about how they great they are, but I don’t see it that way. Matter of fact, in my metro area Chase lost marketshare because of these moves.

The 90% number is amazing with a $450 annual fee, although most customers are savvy and understand the $300 travel credit brings it down to $150. For $150 you get a lot, so kudos to those making the decision. My mom is one of those renewals – I’m 20/24 so will never have the card unless they change the 5/24 rule.

Chase Reserve hits the Trifecta for me. At an annual cost of $150 (after the $300 travel credit applied to the annual cost of $450), I have three great benefits: Priority Pass Lounge access, excellent travel insurance coverage as well as double purchase protection, and 2x points for travel and dining. In my home area–Southwest Florida–Chase has expanded their footprint, there is almost a Chase on every corner. That said, it seems like Chase is following the money, as there is a lot of wealth moving to the Naples/Sarasota area.

Even with just 4 biz trips annually Reserve makes sense for me. Chase hit it right with the card, let’s hope they don’t water it down. But with 90% retention they won’t mess with success.

waiting for next incentive to sign up

They answer the phone. I had to call another card recently and waited on hold for decades. I feel like I’m always talking to an individual as soon I get on the line. I think I’ve had to call 3 or 4 times in the 15+ months I’ve had it and it was surprisingly delightful. I never thought it would be a factor but the phone availability solidified my decision to renew.

I agree about the phone system being a huge selling point.

I have 5-6 active credit cards and am a very high spender (mostly $10k+/month of work travel). A year ago, I had to call Citi and American Express about some issue and had to wait on hold for a long time and talked to people in foreign call centers that weren’t very helpful. At Chase, I just call and talk directly to a person with no wait. As a result of this, I’ve switched 100% of my spending to my Chase card and am considering switching my deposit and investment relationships to them as well.

Chase has done an exceptional job with customer service across their cards. I migrated my spend to three Chase cards: Sapphire Preferred (personal spend), Sapphire Reserve (T/E and client-reimbursable spend) and Ink Business Plus (non-reimbursable business spend). Main reason? Superior customer service. The big loser was AMEX Platinum (cancelled it after I was kicked out of LAS Centurions Lounge for not having a seat assignment printed on boarding pass, was due to flight cancellation/AA IRROPS, and not my fault).

Hey Gary,

Any idea if this info was updated in 2019? Also do you have an idea of how many CSR cards are out there?