Etihad owns:

- 49% of Air Serbia

- 49% of Alitalia

- 40% of Air Seychelles

- 33% of Darwin Airline (now Etihad Regional)

- 29% of airberlin

- 24% of Jet Airways

- 24% of Virgin Australia

As I’ve written India is relaxing its foreign ownership rules so Etihad will face a decision as to whether to up its stake in Jet Airways.

The airline’s minority interests don’t just underestimate the practical control Etihad has over the airlines in which it invests.

One of the ways it exercises this control is by purchasing controlling stakes in an airline’s frequent flyer program, something they’ve done with airberlin and Jet Airways. While foreign ownership restrictions limit equity in an airline, they do not generally limit ownership of an airline frequent flyer program.

Etihad purchased a majority stake in the Jet Airways JetPrivilege program and a 70% stake in airberlin’s Topbonus program.

Two other Etihad equity partners have spun off their frequent flyer programs: The Alitalia MilleMiglia program is run by separate company Alitalia Loyalty, whose creation predates Etihad’s investment in the Italian flag carrier. Virgin Velocity spun off as a separate program as well, selling about a third to Affinity Equity Partners.

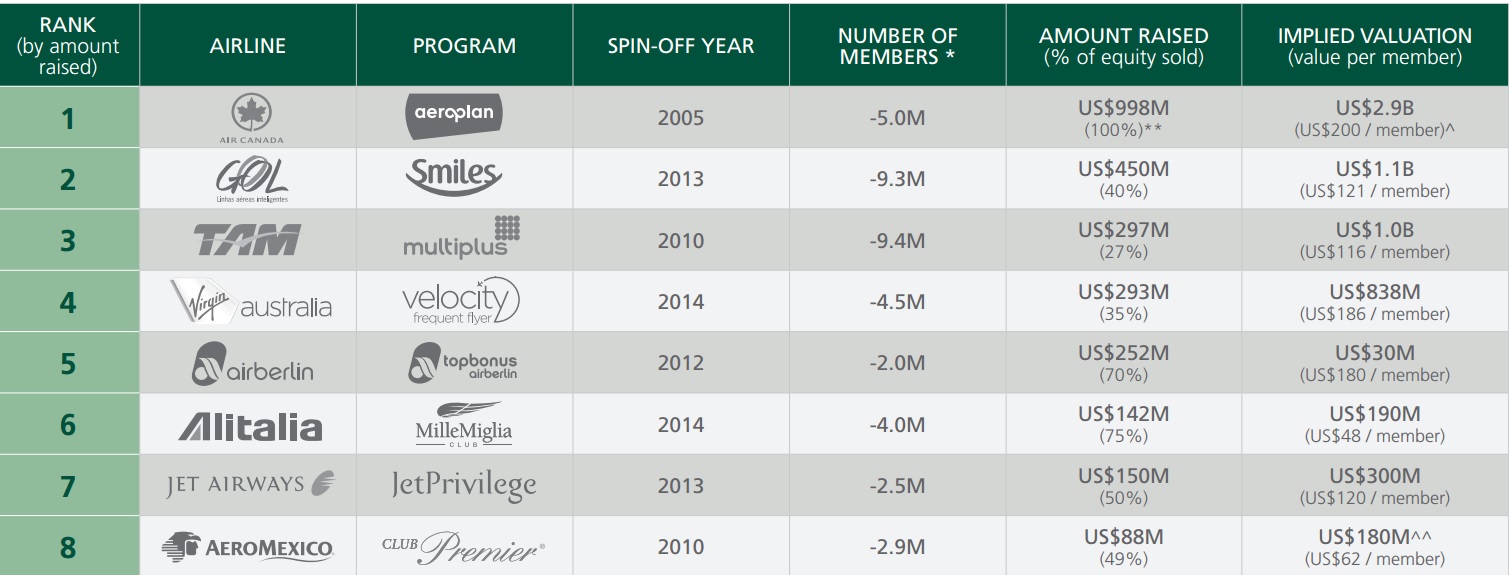

The implied valuation per member (.pdf) of frequent flyer program spinoffs range from $50 (in the case of Alitalia) to $200 (in the case of Aeroplan) according to an L.E.K. Consulting report. In the highest value deal, which was also the first, you had a 100% spinoff of a program with relatively little competition in its home market.

(Click to enlarge data from L.E.K. Consulting study)

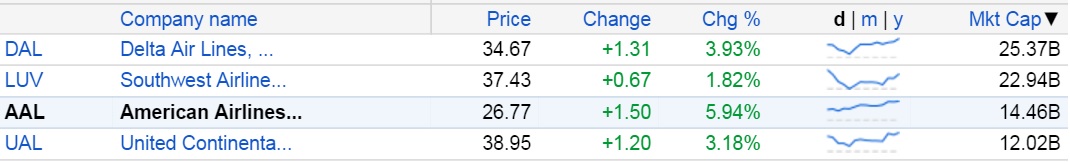

Interestingly on this simple, back of the envelope, basis the big US programs could be worth $5 – $20 billion each. Compare that to their market caps:

I’m somewhat skeptical that valuations are as high on a per-member basis as Aeroplan. Certainly no other program has reached the price Aeroplan did a decade ago. The US market is far more competitive. And the big revenue streams from selling miles to banks could have a limited time horizon. Although given $2 billion a year credit card deals a valuation closer to the middle of the range is likely not far off even if that revenue stream won’t last in perpetuity.

Nonetheless, there’s significant value locked up in the programs, and from Etihad’s perspective they’re also a mechanism of control outside the purview of traditional foreign ownership restrictions.

Interesting article. Help me understand the benefit in an airline purchasing the frequent flyer program. How do they make money? Will the frequent flyer program have to be sold to another company to obtain a return?

@Larry The programs effectively sell miles/points to their former host airlines. When points are redeemed, they then purchase flights from the airline for (hopefully) less than the cost of the sold miles.

As an example: Aimia, the parent company of Aeroplan and part owner of other reward programs, posted a $13.1 million loss last quarter, but had a $23.4 million profit in the same quarter last year.