I love Alaska Airlines and the Mileage Plan program, but I love it a lot less this morning. While they don’t have plans to go revenue-based and most of their awards remain reasonable, they have gutted their award chart for travel on their partner Emirates and they have done it without notice. And devaluations without notice are the single worst thing a loyalty program can do.

Emirates has been my favorite Alaska Airlines Mileage Plan redemption. They fly to a number of US cities and have a fantastic first class product especially onboard their Airbus A380 which has showers.

These awards are mostly going to be out of reach now for Mileage Plan members.

In fact the changes are so dramatic that it makes me wonder if they were put together by Alaska’s drunk pilot, drunk flight attendant and drunk passenger.

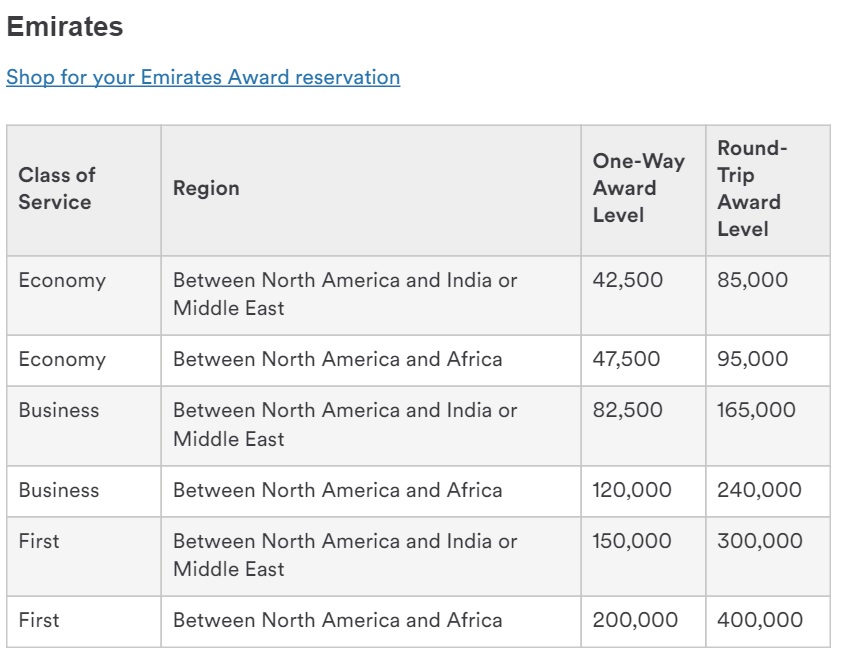

Mideast and India awards have gone up to 82,500 in business each way and 150,000 in first. Africa has gone up to 150,000 miles in business class and 200,000 in first each way. An Africa roundtrip in first class is 400,000 miles per person, and that’s for a saver award.

Asia awards via Dubai are now 105,000 miles each way in business class and 180,000 in first. Just two months ago I flew Houston – Dubai – Bangkok for 100,000 in first. This is an 80% increase overnight for that award.

The interesting thing is that US-Europe awards on Emirates haven’t been gutted. And those connect in the Middle East. You’re allowed a stopover on a one-way award. So it’s far cheaper to book US – Dubai (stopover) – Europe and throw away the Dubai – Europe segment than it is to book US – Dubai one way.

Emirates itself is a transfer partner of American Express Membership Rewards. Their awards get expensive as you go up in cabin and distances become greater, and there are fuel surcharges. It’s not super practical for long haul first class travel. Qantas is a Citi transfer partner and offers good awards for New York JFK – Milan with fuel surcharges, but gets super pricey for long haul. Korean Air awards on Emirates are pricey.

In general the best awards for Emirates travel will be via Japan Airlines Mileage Bank, a oneworld frequent flyer program that’s a Starwood Preferred Guest transfer partner. They have a distance-based award chart.

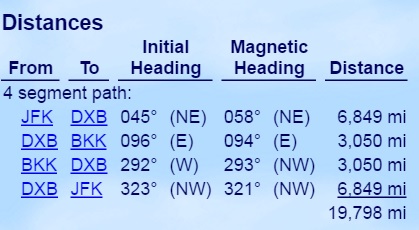

Trips between 14,001 and 20,000 miles cost 100,000 miles for business class and 155,000 miles for first class.

New York JFK – Dubai – Bangkok roundtrip is just shy of 20,000 miles.

My Starwood points became relatively even more valuable to me, for their ability to transfer to JAL, with this change to Mileage Plan.

(HT: Zohalb J.)

Update: 7:56 a.m. Eastern: it appears that North America-Europe awards have been devalued too, even though that change was not reflected on Alaska’s award charts. At some level that’s even worse, if there could even be such a thing.

Thanks for the news. Re: the news – Probably the single worst devaluation notice I have received…. ever. I have just over 200K in the bank with them and was working on scheduling a trip.

One way to Europe is pricing at 180K in practice.

The award chart says 100K but prices out at 180K

I also see the same 180k pricing for NYC-Milan…

To put things in perspective, it would be nicer if you include in writing the previous mileage price of each award for easy comparison, as not all readers remember the old award level off the top of their heads.

Here comes regulation. I have been saying it for years, points are currency, people save them for years… Devaluation is something that needs to be announced… If not, government will regulate it.

Really appreciate the info, was meant to buy more miles by today. Now I just have to put it back into my wallet.

So much for the Maldives trip I was trying to book on Alaska award!! I get that programs devaluate, but not giving warning is underhanded!

It seems NA to EU via dxb is dead now.

So the race to the bottom commences; AA got off with an audacious start (with plenty of notice though) , then one-upped by Alaska, who gave no notice, and got nastier. To think they used to be my favorite program! All great for them while people spending, but come the inevitable cyclical economic downturn, and who will be crying then?

Pure coincidence that TPG just mentioned these redemptions in a Travel + Leisure article a couple days ago…?

http://www.travelandleisure.com/travel-tips/points-miles/starwood-points-marriott-merger

It’s time for everyone to ditch the mileage earning credit cards and switch to a 2% cash back card. Way more value than anything left out there. If enough people did this, the airlines would feel the pain next time their bank relationships come up for renewal. You’ll also see sign-up bonuses spike when banks have billions of miles they can’t get rid of.

Can you also confirm if the KE chart took a hit as well? I never paid attention to it until today, but it seems awfully high.

Alaska Airlines has been infected by the Delta Virus.

This is what happens when you abuse a system… Miracles have a finite lifecycle

@Tony KE chart is showing roundtrip pricing not one way pricing which is why it looks SUPER high..

General theme across the board: the days of arbitraging native currencies for relatively grossly underpriced partner awards are coming to an end. Whoda thunk it?

Does JAL have fuel surcharges on an Emirates award?

@Corky yes, they did not used to but they do now..

@JimmyP: I will switch to 2% cash rebate cards as soon as the big miles and points signup bonuses end. I earn much more from those bonuses than from ongoing spending.

You won’t get an aspirational award with the 2% cash back card, but at this point it takes so much spend (even dramatically more as Gary brought up here) to get those awards that better to just in most cases to get the cash and buy what you need. And I am speaking to regular spend here, not sign-up bonuses or other special category spend.

I hope this was an april fools joke and someone pulled the trigger too early

Thanks for posting this news and analysis, Gary, even though the news is so bad.

Can’t really blame AS management – the old levels were not competitive (way too low compared to other programs) and AS doesn’t really need customers who are simply gaming the system to fly Emirates. Really the only question is why it took them so long.

I will continue to fly AS for their low fares and friendly service, and hopefully there will now be a few more seats available for upgrades 🙂

You can definitely blame them for doing this with no notice whatsoever. That’s bait and switch.

I blame bloggers for this 100%

This is (indirectly, of course) yet another blow to Amex. Its the sole reason I was putting spend on my SPG card.

@Johnny33 of course you do.

I wouldn’t put the entire blame on the bloggers. However, I would point to one who GLOATED about paying xxx amount with AS miles for a trip that would of cost USD 60k. That particular person received a lot of press coverage about it. He was doing interviews in Australia and various online websites. I would assume EK noticed this. That blogger is awfully quiet today.

It wouldn’t surprise me if there is some consumer protection laws that come out of this (as congress has already tried with the size of seats) that mandate notice must be given before currency devaluations.

Relatively new to this game (terrible timing-I know) but I guess this teaches me to only transfer UR or MR points when you are ready to book the actual flight and not a minute earlier.

@Tony don’t know who that is

This is unfortunate, I was going to book a trip yesterday and was caught up with work related scut and put it off to the weekend.

Quick and the dead! Major bummer.

Makes AA, the moral compass for for devaluations.

#sunrisesinthewest

@GaryLeff~ you are being too cute in ‘not knowing’ who has repeatedly splashed the great value EK (premium cabin) was with AS MileagePlan (emphasise WAS) all over his blog, complete with copious pictures!

Lucky/Ben is not known for being circumspect about anything, and articles like he has posted about EK are his bread and butter I suppose, (along with CC kick-backs) so none of it is the least bit surprising. Maybe he didn’t need to trumpet it so loud, and so often though.

Does JAL allow awards for anyone (friends and family) or just immediate family, like other North Asian carriers?

I think Amex actually became better; you can send points to Emirates and pay a bit in fees but travel in F class.

I have been flying since the 70’s on Eastern, Piedmont, TWA, Braniff, Delta, American, and United when all these programs 1st came into existence. My points came from sitting in seats and being away from my wife and kids. I amassed so many points that I was selling them until American said they would ban me. I bought a car with money from points. I gave away so many trips to family. Both my kids got plane trips and hotels to anywhere they wanted for their honeymoon. I amassed somewhere around 3,000,000 Marriott points. Now down to about 1/2 that. I have seen all these programs change bit by bit. The credit card bonuses were not created by you or me, but the airlines. They would be an idiot to believe people would not churn these. In my 40 years of travel, I think the product has come a long ways. I still do not like what Alaska did, but maybe it was Emirates that forced the change. I feel like the butt in the seat guy needs rewarding more due to his or her loyalty. I think Delta has tried.

Wow, people blaming bloggers. That’s funny considering most of them would not have known about the great values without reading blogs.

“John” @ April 1, 2016 at 7:43 am said: “I feel like the butt in the seat guy needs rewarding more due to his or her loyalty.

Thank you!!! I used to be Gold on DL purely from BIS miles flown (all on my own dime), and now I’m not even an Elite anymore after their “Keep descending” conversion to a Frequent-Spender Program. The whole revenue-based thing seems geared specifically to throw out “the little guy” who squeaked by – without gaming the system through other spending methods – and actually flying the miles.

“I think Delta has tried.”

Now that on the other hand I disagree with. DL sure jumped on AA’s bandwagon fast.

I am glad I book Emirates a few weeks ago with Alaska. It wasnt a smooth process over the phone either and took a few days to get things right. I have some major awards booked this year where I grabbed and booked these awards when I saw them available. Jimmy P is right. These programs are drying up fast. For most people 2% cards are the way to go. For me I have flexibility and I have been able to get bookings using a mix of airlines and destinations. With the upcoming devaluation coming with SPG, things are really coming apart. I still think the average person can score a nice vacation each year with credit card bonuses and such, but things are definitely getting much harder.