American Airlines engaged in mass shutdowns of AAdvantage accounts four years ago over customers who used invitations to apply for Citibank credit cards which didn’t say circumvented rules limiting how often one could get a bonus. People lost millions of miles. And there’s a new lawsuit against American Airlines over taking these miles away.

What happened is that some people created fake accounts to get these mailers that allowed them to apply for cards over and over – at scale. Some people may have gotten caught up in the account shutdowns who were far more innocuous.

- When you’d open a new AAdvantage account, you’d receive an offer to apply for a Citibank credit card. That invitation didn’t prevent you from earning a bonus if you’d earned one in the past. After all, it was being sent to someone with a brand new account.

- These invitations were transferable. Some people may have opened an account for a child taking a trip, and used the invitation themselves. That’s pretty innocuous. But I don’t know of anyone whose account was shutdown for doing this just once.

- Most cases seem to be people who either opened fake AAdvantage accounts (think: in the name of fake people or pets) or who purchased invitations on Reddit or FlyerTalk for $5 – $50 each.

- People getting 4 or more initial bonuses from Citibank personal cards in two years (when the normal limit is currently one per 48 months) seemed to get shut down).

Everyone who contacted me about this when their accounts were shut down, as I asked questions, more of their story comes out than they offered initially. Usually they stop answering my questions. It seems, anecdotally, that most of the people caught weren’t as innocent as they presented themselves at first.

That doesn’t mean there weren’t people innocently swept up in the shutdowns. For instance, here’s one member who says they accumulated miles in their own account only based on application invitations sent to their children after opening AAdvantage accounts for their kids. They used four mailers in two years.

More common though were people opening more than 20 AAdvantage accounts and over 50 credit cards over a four year period.

What American Airlines Says About These Shutdowns

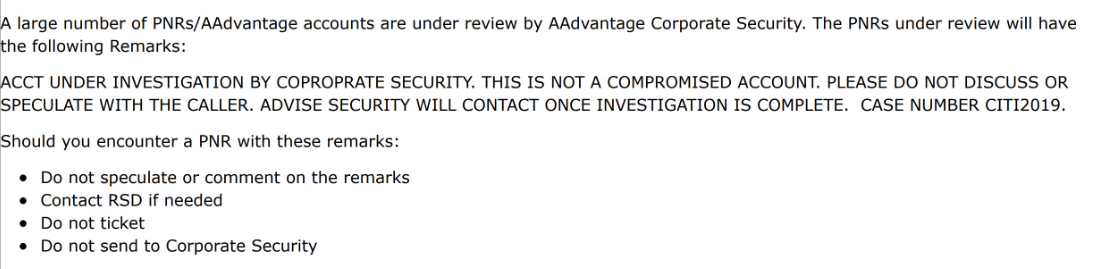

Here’s what American told its agents at the time that accounts were being closed, to arm them with information when customers called:

According to an American Airlines DOT filing in response to complaints, American learned about the tactic for getting unlimited card bonuses by monitoring FlyerTalk and Reddit.

They ascribe the lack of a bonus restriction on the application people were using as “due to a technical issue” that “certain unscrupulous individuals” used “to circumvent security protocols.” In other words, Citi programmed their systems poorly.

American argued falsely that the existence of a 48 month rule on most applications means that it really should apply to all applications, even though application rules have changed regularly over time.

They also argued that bonuses are only for “first-time account holders” which is obviously untrue when they simultaneously argued that bonuses should be read as only available every 48 months, even when an application neither says so nor enforces this rule.

online commentary about these card shutdowns and this case, assuming that the bonuses themselves were profitable to American.

online commentary about these card shutdowns and this case, assuming that the bonuses themselves were profitable to American.

- American benefits from adding credit card customers

- So, generally, an airline and co-brand issuer ‘partner’ on acquiring customers

- The bank will pay for initial bonus miles, but won’t pay as much for those miles as they do for miles earned from ongoing spending

- American receives an amount that’s closer to their internal cost for up front bonuses.

My understanding is that a mile ‘costs’ around 74 basis points to produce, though when a passenger receives miles for tickets flown the airline will book around 1 cent apiece for those miles as future transportation liability. I believe American’s co-brand partners will pay about one cent per mile on acquisition bonuses.

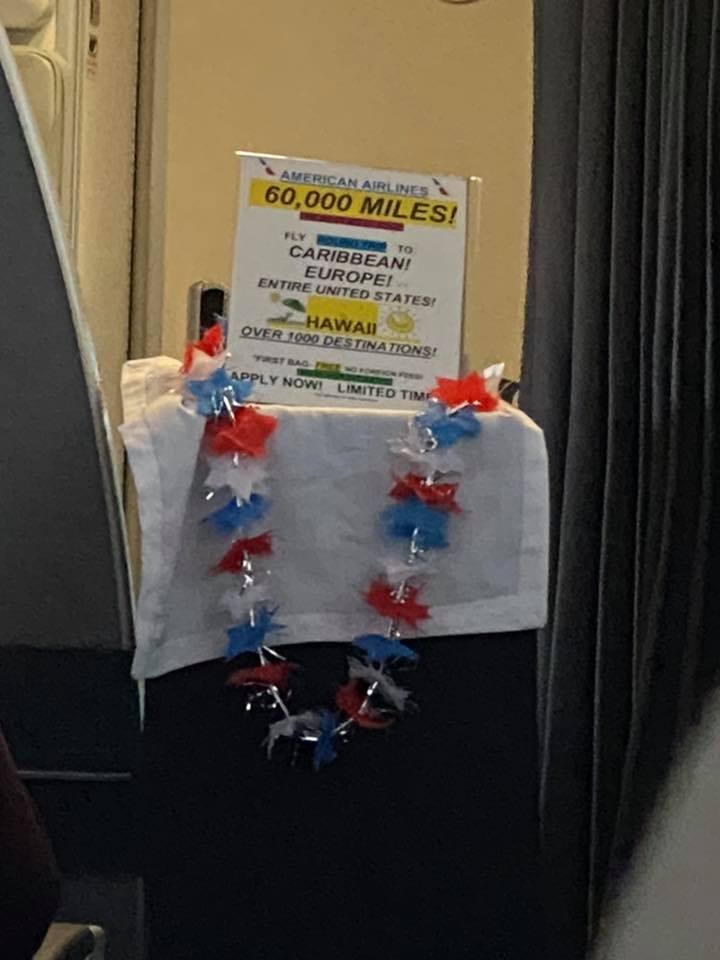

Customers Could Also Apply Inflight For A Barclays AAdvantage Credit Card

This Lawsuit Seems Like A Long Shot

The class action seeks to include customers whose accounts were shut down in late 2019, past the four year statute of limitations. The theory in the filing is that it didn’t begin running when AAdvantage accounts were closed, because American’s explanations of the closure were generic, and the clock only started ticketing once the members got a detailed explanation of why their accounts were closed. For this, the plaintiffs need a judge to indulge the theory that not giving more detail on the closures was ‘fraudulent concealment’.

What the case comes down to is that

- Generally American can do what it wishes, and its terms even say class actions are excluded,

- There were some pretty bad actors, who misrepresented themselves to gain bonuses and those customers make bad plaintiffs.

This is going to be tough as a class action because members of the class are distinguishable, and bad actors aren’t going to get successfully lumped in with a handful of customers who may have unfairly had their accounts closed – and this latter group seems pretty small.

Here’s a copy of the lawsuit (.pdf).

Loyalty now a thing of the past. It’s staggering how devalued miles have become. One used to be able to fly across the Pacific for 65k miles total both ways. Now you can’t even get halfway across the country for that. The age of accumulating points is largely over and it is a fool’s errand. It’s time to have zero loyalty for any airline since they have zero loyalty to you.

How about all of the share-holders like myself who lost $$$ after the US Airways merger?!

AA just keeps taking and taking with no repercussions, huh?

@Fmb

Not just airlines, but any company. Customer service is no longer about who can be the best, but just about who can be second from the bottom or better. Brand perks are just that, minor perks and that’s it. Miles are good for a free checked bag or maybe a seat upgrade to the highest cabin, such as Delta comfort plus or preferred seating.

That’s why I always told people that I’m loyal to a functionality / feature, not whoever provides that to me. If somebody else starts providing it to me better, either in better customer service which is my main priority for ranking, or in better product, then I am loyal to them as long as they provide that better than anybody else.

Class actions almost are always settled after opposing parties file their evidence and motions, but before the trial. The damages which individuals are awarded are never substantial, and rarely related to actual damages. The defendants want the legal fees to stop, and the plaintiff attorneys want their juicy paychecks sooner than later. It’s all a racket for the lawyers involved. Most of these suits would go away if legal fees were limited to 10x of what the lowest member settlement of the class received.

It’s all about getting whatever they want.

That lawyer/law firm is a joke. They cannot even get some of the basic facts correct. As a litigator, I would double/triple check what I drafted to ensure everything is correct before putting it out there for consumption by the general public. This lawyer/law firm apparently did not proofread the complaint, neither did the clients apparently.

The complaint states that the plaintiffs are residents of “Los Gatos (Santa Cruz County), California” when Los Gatos is located in Santa Clara County, a very basic fact that should have been revealed when their clients were first interviewed by the lawyer/law firm. Plaintiffs should have known that, and a very basic search on the interwebs would have resulted in the town profile from the town itself: https://www.losgatosca.gov/DocumentCenter/View/8301/Town-Profile?bidId=

I lost interest after such a ridiculous oversight. Good luck to the clients who may very well have been damaged but when they chose a lawyer/law firm of such low quality control, they deserve what they get.

Zero sympathy for the grifters that try to game the system. Same viewpoint on the max spend and gift card shysters. First of all agree that it is VERY doubtful a judge would extend the statute of limitations. Also, I didn’t see in the lawsuit if it was already a class action or if the ambulance chaser was trying to get class action status. If so, agree that also is a stretch given the widely varying circumstances and actions of the allegedly aggrieved parties. Even if both are accepted by a court (very long shot) then you get into terms and conditions of the program and also a defense of fraudulent actions by certain plaintiffs. Summary is unless AA wants to pay a token amount like under a million (which I know seems like a lot but legal and court costs can add up quickly) to just make it go away I don’t see anything coming of this. BTW, if they do pay it would almost certainly go in the ambulance chaser’s pocket and no plaintiff (outside of maybe the one named party) would get anything except an agreement by AA to either modify future terms of the program, clarify rule or maybe a $100 discount against future travel (which really doesn’t cost the airline much at all).

Pigs get fat, hogs get slaughtered AND even get the farm shut down for the rest of us. The lawsuit should be from other AA members that didn’t get more miles because of people churning this too far.

None of the accounts were shut down in 2019 (except maybe one or two people). The shutdown emails arrived generally in Jan/Feb 2020 so statute up of limitations of 4 years is fine

“In other words, Citi programmed their systems poorly. ”

I’m shocked!

People who are saying the class won’t get substantial relief if the suit makes it through class formation and AA’s inevitable MTDs are wrong. The individuals suffered substantial and verifiable losses. This isn’t everyone gets credit monitoring for six months. Should the lawsuit pass those thresholds AA will pay because the potential damage to it’s control of the program is way too big to risk a formal judgment.

A mild correction–the number of friends/pets/plants accounts didn’t need to be large (e.g. 20) because Citi’s velocity limits meant you only needed a handful of mailers per year. 50 cards for one account would also have been impossible.

Oh, and one more thing–AA did not act against distinguishable members of a class. It whacked purely on number of bonuses. They won’t be able to argue that they were selectively targeting fraudsters.

@Blue – AA acted based on data from their analytics software of missies of the offers in violations of AA’s rules. 99.9% of members weren’t impacted. Also, as Gary noted, once you dig into it the vast majority end up being bad actors clearly in violation. As for 50 cards – did you not read that some people bought offers from Flyer Talk and Reddit? Some used over a hundred offers.

As for a class I still contend it will be very difficult to establish a class action due to the variance in actions. AA will fight that (as they should) and likely win. This isn’t the case of a homogeneous group exposed to the same potential risk – many willingly took part in creating it.

I’m n any event I hate civil litigation and the view of so many Americans that any time something happens they should cash in. I’m all for significant caps on awards, elimination of class action lawsuits and other corporate protections. Of course as long as the Dims are in power that won’t happen as they hate business and pander to the lazy grifters and ambulance chasers.

@Blue – Also AA didn’t take anything away as their rules clearly state the airline is ALWAYS the owner of the points (not the flyer) and has broad authority to change the rules or shut down accounts.

AA wouldn’t do it due to marketing reasons but they could actually just shut down the entire program and declare all points null and void. Legally their rules also this – the program exists are their sole discretion

@Duckeduck It must be a very quiet life you lead if you’re only interested in things that are perfect.

@RetiredGambler, you literally could not have 50 cards on a single AA account from this hack due to Citi timing issues for new cards. Trust me, I was deep in this.

There literally was no “variance in actions”, either. Everyone was using the exact same offer.

@Blue – Gary reported some with over 50 cards. Also people set up multiple accounts using pet names, fake names etc then loaded those with cards. Do a little research on other blogs and see how some even bragged about it.

As for the same offer, that is not relevant for a class action, You have to have similar exposure and risk profile. It wasn’t the offer that is the problem as the vast majority of people using it weren’t impacted, it was the fact the offer was misused against AA policy and, in some cases, in a criminal matter.

Of course that doesn’t stop some ambulance chasers and sleazy grifters looking for a handout

Trust me – this is going nowhere.

Dude, you don’t get it. I’m not reading about this second hand.

For one thing:

NO PET OR PLANT EVER GOT A CREDIT CARD.